How Successful Companies Validated their Product-Market Fit

Introduction

Before we start on any project at Off The Record, we ask the question: has this company achieved Product-Market Fit (PMF)? If they haven't, that's what we work towards to with our validation methods and way of working. If they do have, we can start talking about scaling the product/service.

Does it seem simple? It's because it is. Growing without PMF is detrimental.

In this essay, we cover what PMF is and how to identify it (both problem and solution). We also examine the consequences of investing in growth before PMF (churn and difficulties in expansion).

To exemplify how to measure and identify PMF, we go cover three ways three successful companies (Zynga, Superhuman, Innocent Drinks) validated their own PMF. These examples show there's no one-size-fits-all for measuring PMF. They depend on industry, company stage, business model and the problem/solution.

💡What is Product-Market Fit and how to identify it

The short and sweet version: Product-Market Fit (PMF) is having a product that satisfies a certain market's need.

Product-market fit pic.twitter.com/Wx8DlovsNt

— Ryan Hoover (@rrhoover) January 21, 2020

For us at Off The Record, Product-Market Fit is a term that encompasses the two pillars of building a successful and scalable product: the problem and the solution.

Problem: how big is the problem you're solving?

Sequoia, arguably one of the most successful VCs in the tech industry, looks at PMF in a very enlightening and easy-to-understand way. They talk about finding customers who "have their hair on fire".

What does it mean? Let's say you're standing next to Sally and she has her hair on fire. Sally has other problems - maybe she'd like to spend less time commuting or would like to take better quality photos - but she has a really big problem that trumps all others. Her hair is, literally, on fire.

If the problem you're trying to solve is that important to your customers, your first product iteration can be validated easier. A half-baked solution, like a bucket full of sand, can be enough to reach product-market fit for users like Sally.

User satisfaction: how passionate are users about your solution?

The size of the problem doesn't matter if you're not fulfilling users' needs. A solution that doesn't put the fire out of Sally's hair certainly won't rock her world.

To Sam Altman, Y-Combinator's president, rocking users' world is precisely what early stage products (pre-PMF) should focus on. To him, the right initial metric is “do any users love our product so much they spontaneously tell other people to use it?”.

User satisfaction and passion has two knock-on effects that are necessary to a product's growth: retention and referral.

Happy users retain, so you can spend less (time and $) in acquiring leads, trials or first-time visitors.

Happy users tell others and bring you organic growth, so you grow faster and better.

As Marc Andreessen himself nicely puts it, product-market fit is when "the customers are buying the product just as fast as you can make it"

The low-down: If you're solving a big enough problem with a solution users are willing to recommend to others, you have product-market fit.

But here's the catch — Product Market-Fit is not an "end destination". Or, at least, that's not how we approach it at Off The Record. As you scale — both by adding new services to your product or by expanding to new markets — your PMF will evolve.

🏆 Why Product-Market Fit matters

We work closely and often with multinationals at Off The Record. Often, what to we see, is that they reach out to us when they want to launch a new product. They've read about "growth" and they would like us to help them grow sales to this new product.

But, before we start on any project at Off The Record, we ask the question: has this product/company/feature achieved product-market fit? This shapes how we move forward.

- If it's post-product market fit, we'll be working on the likes of growth loops, acquisition strategy and setting up a growth team.

- If it's pre-product-market fit, then we'll be a one-way track to reach PMF.

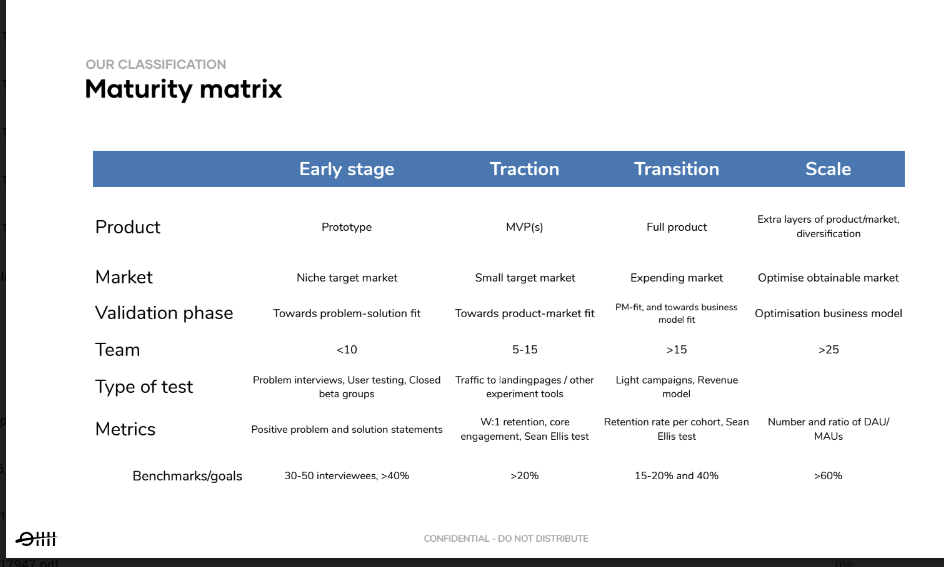

Below, you can view how we quantify at which stage a product is at and what is needed to validate at each stage:

It is simple, because it's counterproductive to work on growth before PMF. And there are two main reasons for that:

1. No PMF = Leaky Funnel

As we've seen above, one of the pillars of PMF and of building a successful product is user satisfaction. If users are not happy with your solution, they will churn. It will be difficult to grow your revenue by putting volume top of the funnel if users are spilling out of the bottom.

At the pre-PMF stage, your product and positioning will go through iterations. The best thing growth can do at this phase is gather learnings and help validate hypotheses. Top of the funnel can be very valuable for that, but not for acquisition.

Here's an example of how top of the funnel experimentation helps PMF, not growth:

- Your product manager interview potential consumers and lists their core problems.

- Your product marketer translates those problems into different product messaging and positioning.

- Your performance marketer tests these messages through social campaigns for your hypothetical target audience.

At the pre-PMF stage, setting growth goals can be detrimental - you can try to paper it with 'growth hacking' - but when you start digging through retention numbers, you will see it won't stick.

When your funnel is still leaky, growth's most important role is to validate and not acquire.

2. It's easier to expand user-wise than satisfaction-wise

We've written previously on the reasons why Dutch startups struggle in other markets. One of the main causes is they invest in international expansions before they've found PMF. In other words, they invest in "user expansion" before "satisfaction expansion".

At an early stage, it's better to focus on making a certain subset users very happy with your product than to have a large subset of users who are ambivalent.

The main reason for that is very straightforward. It's easier to acquire users for a product that people love, than to make people love a product they use. And — an added difficulty — is that the bigger your user base is, the more challenging it is to build an universally loved product. It is easier to please 100 people than 1,000.

One of the companies we'll cover in our examples, Superhuman, did a great job finding those pocket of users that loved their product.

🚨 So don't skip the MVP (minimum viable product) stage

There's one main takeaway from all of this: it is necessary to validate a solution before scaling it. We've seen startups and corporates get too excited and fixed on a solution too soon. They hire sales teams, spend big on performance marketing, raise money and expand internationally. Only afterwards they realise the need is too small or the solution is not right.

In a good market, an MVP is all you need to get initial customers through the door giving you feedback to inform you where to shape the product.

With the rise of NoCode tools; building, launching and validating has gotten easier and faster than before. We were recently taking to a prospective client that had a product idea they were interested in launching. They wanted to invest 2 months to build a first version and start selling. We built an MVP with Airtable, Zapier and WebFlow in two days.

3 Ways Successful Companies Validated Product-Market Fit

As we've seen above, there are two main pillars of building a successful product: the problem and the solution. If you're solving a big enough problem with a solution that users are willing to recommend to others, you have product-market fit.

There are many, many different ways to validate or quantify Product-Market Fit. We've looked into the stories of how three different companies (Zynga, Innocent and Superhuman) validate(d) their product(s):

🎮 Zynga: Word of Mouth Coefficient

Who are they:

Game developers behind hits like Farmville and Words with Friends

What they did:

There are some particulars to mobile games that are relevant to talk about before we get into this.

Mobile games usually suffer from weak day 1 retention: users will install them, maybe play once and never come back again. Their average LTV (lifetime value) is also low because of their usual freemium model paired up with a low conversion rate.

Then how do you build a successful mobile game product? By pouring a lot of people top of the funnel.

Over the last 10 years (Farmville is now 11 years old), CPIs (cost per installs) have climbed up across all platforms. Anecdotally, I remember paying a CPI as low as $0.30 back in 2014 on Facebook and I haven't seen any company get installs under $1 this year.

Therefore, product-market fit for a mobile or social game is being able to generate enough new users organically.

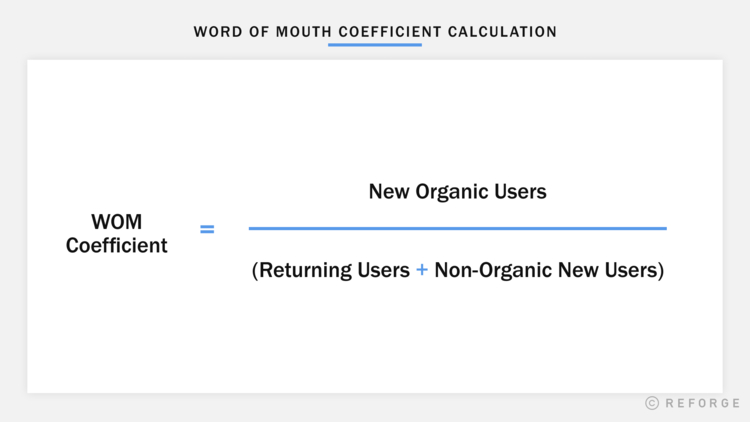

In order to estimate a product's growth, Zynga developed a metric called "The Word of Mouth Coefficient" (WOM Coefficient). This metric is calculated by dividing New Organic Users / Active User. If you have WOM Coefficient is 0.2, it means that every 10 WAUs (Weekly Active Users) bring 2 new organic users per week.

What it teaches us:

How to measure PMF and what will make a product successful is dependent on what industry you're in. For mobile games, word of mouth is what makes it or break it a product. Zynga understood and developed a metric to track PMF that was valuable specifically for them.

💪 Superhuman: Quantify User Satisfaction

Who are they:

Email client for power users

What they did:

Superhuman created a framework to quantify and measure PMF in a rolling basis. We'll summarise how they did that, but it's worth reading the original article on it in full. This is a framework we often employ at Off The Record to validate products that already have a few tens or hundreds users.

Superhuman was struggling to find PMF until they talked to Sean Ellis, the man who coined the term "growth hacker". Ellis had found a leading indicator on whether companies had PMF:

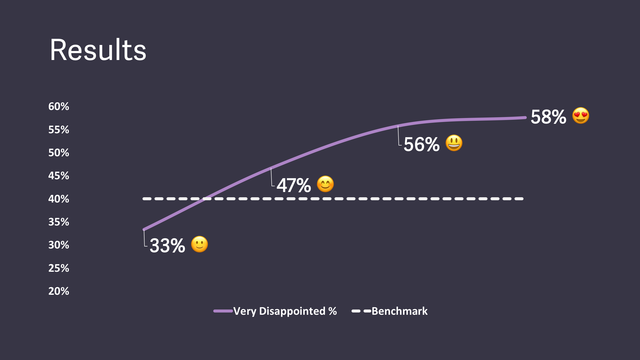

Ask users “how would you feel if you could no longer use the product?” and measure the percent who answer “very disappointed.” If it's over 40%, you've found PMF.

An example given in the article is Slack, who asked its 731 users that question back in 2015, and had a result of over 50%.

So Superhuman went to reverse engineer their PMF. They created a survey that asked users that same question, as well as some additional questions like "What is the main benefit you see from Superhuman?" and "How can we improve Superhuman?". They segmented these responses per user persona (e.g. Startup Founder).

In their first iteration of the survey, 33% of users said they'd be very disappointed if Superhuman stopped existing. To decrease the noise of early users that were not their target market, they only looked at answers from their key personas.

They deep dived into the answers from the "very disappointed" users to understand their main needs and the value they were getting from the product.

Superhuman repeated this model many times - they used this framework in order to identify their core users and to keep them satisfied. When they found (and quantified) PMF, they were ready to run and focus on growth.

What it tells us:

At early stages, It's important to identify and focus on your most passionate users. Using a quantifiable framework helps you decrease bias and clear the noise.

🥤Innocent Drinks: Talk to Your Users

Who are they:

Smoothie makers with a strong brand presence

What they did:

Innocent is not the usual type of company that we'd cover at our Off The Record blog. They make smoothies and they sell their products at brick and mortar stores. I found this product validation story accidentally: they're so proud of it that they have it on their website.

They started Innocent in 1999 after selling smoothies at a music festival. They put up a sign asking people if they thought they should give up their jobs to make smoothies, and put a bin saying 'Yes' and a bin saying 'No' in front of the stall. People voted with their empty smoothie bottles. At the end of the weekend, the 'Yes' bin was full so they quit their jobs.

What it teaches us:

There's no better validation than people willing to spend money on your product. Ideally you let user order in advance to see how serious they are about ordering, which will help you with the cashflow of your business too. However, it's always useful to talk to your users, or potential users. It can be as simple as asking them a yes/no question.

🤓 How we approach Product-Market Fit

Throughout this essay, we've seen why product-market fit is so pivotal for a product's success. It's needed in order to retain users and to expand to new markets. We've also learned how three successful companies (Zynga, Innocent Drinks and Superhuman) validated their own PMF.

For this section, we cover five activities we ourselves do at Off The Record to help our clients validate their PMF:

- Problem interviews •

At prototype stage, we focus on identifying and validating the problem through user interviews. In these interviews, our goal is to understand how users are currently solving the problem and what could be an MVP (minimum viable product) that fulfils their basic needs. We use The Mom Test which is a self-titled way to "talk to customers when everybody is lying to you". We prefer to do these interviews face-to-face (or, more recently, over video call) instead over email, survey or the phone because of body language. - Beta user groups •

When we're still refining what the MVP will be, we aim to get user feedback early and often. We'll usually put interviewees that fit our targeted personas from our niche starting market into a beta user group. We create this group on a tool, usually Slack or Whatsapp, that is already used by the target audience. This allows us to build a pivotal early stage feedback loop to feed the product development team. - Landing page validation •

Our first iteration of an MVP is usually a landing page defining the proposed solution with an email collect and waiting list, similar to how Buffer originally launched. For hardware or physical products, crowdfunding platforms are a good way to validate interest in a product before building an MVP. - Audience tests •

Once there's an MVP (either waiting list, crowdfunding or first product iteration), we usually start driving traffic with performance campaigns. At this stage, budgets are small and the goal of the campaigns is not growth, but insights. We aim to figure out which messaging converts to each audience and at what cost. - Sean Ellis (Superhuman) test •

We're big fans of the Sean Ellis PMF question ("How disappointed would you be if you could no longer use Product Y?") and the Superhuman framework. We replicate this by sending a TypeForm to new active users and by overlaying users' responses with product first party data. We also use the ">40%" threshold to quantify if PMF has been achieved.

👩🏫 Conclusion

In this essay, we covered the importance of having Product-Market Fit (PMF) before growth. That's why validating your product and solution - building a product that your market loves - should be the #1 focus of early-stage companies.

The stories of how Zynga, Innocent Drinks and Superhuman validated their own PMF showcased the different ways it can be done:

- Zynga developed a new metric to track referral effect: a behaviour pivotal to the success of their industry, mobile and social games.

- Innocent Drinks created a fun game to gather feedback from their early consumers and understand how much they enjoyed their product.

- Superhuman used the Sean Ellis framework - also used by us at Off The Record - to identify their most passionate users and their needs.

At Off The Record, we see companies getting too excited about a solution and wanting to jump into growth before validation. Often, I hear that they already have PMF but aren't even tracking the right metrics or talking to users. The pitfalls can be big. We've seen companies expand internationally (hiring sales reps, doubling down on performance marketing, opening offices) before PMF only to scale back.

That's why we always start with Product-Market Fit.

If you've enjoyed this article, you should subscribe to our newsletter below 👇