Why most Dutch startups struggle in other markets

Introduction

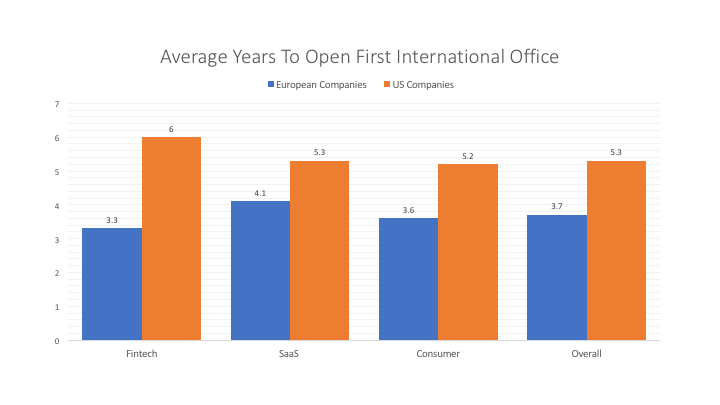

Research shows countries with a population below 50 million go international twice as fast as startups from countries with a population above 50 million: 1.4 years as opposed to 2.8 years. Which is why don't need to go into the importance of international markets for companies like Booking.com, Adyen and WeTransfer. With a home market of just 17 million, all Dutch startups have an eye abroad from day 1.

We've helped some Dutch startups successfully expand internationally over the past years, but we've also experienced first hand the main struggles of local startups. I've written this article to summarise the main missteps I've seen startups take when it comes to launching abroad, also with the inputs of several founders and investors in the Dutch industry.

They're varied - they go from startups rushing in international expansion before product-market-fit to no product investment in localization - and they reveal how tricky is to expand globally. We hope this article will help you identify whether now is the right time to launch internationally and how to approach it.

1. Investor pressure ⚖️

It's a tale as old as time. Startup raises external investment by promising they will scale and grow. In the case of Dutch companies, that is often translated into launching and investing in new markets. VCs see this international expansion as big success in the short term and everyone is happy - or are they?

Not quite. We've seen this backfire for companies before. They invested in internal expansion - both financially and with the time and attention of their leaders - but did not reap the fruits. They hadn't taken all the necessary steps to succeed internationally (and we'll see what they are in this article), but felt pressured by investors into doing so.

We see this investor pressure impacting a company's growth negatively in two cases:

Case 1: Founders didn't pick the right investors

YCombinator's Series A guide has valuable advice on how founders should pick investors. They suggest to look for "do no harm" investors. The best investors, according to YC, are those experienced enough to keep distance. Investors should share their relevant experience, but the ultimate decision lies on the founders' hand. Investors that want to add value by intervening can add more more harm than good - specially in this case.

Case 2: Founders don't know how to get the most of their investors

For angel investor Paul Arnold, some startups don't know how to get their most of their investors. To him, founders should identify exactly what investors can offer them. Is it help finding and hiring the right people? Or is it sending an intro to close a deal? Founders should be proactive in asking for advice, making sure you're playing into your investors' expertise. Founders should engage frequently with investors, but not for taking directions.

We're a growth bureau, so we don't advise founders on what criteria they should use to pick investors and who to take money from. However, there's one thing we stand firmly against at Off The Record: vanity metrics. Startups should never devote time, money and attention to international expansion just to showcase short-term vanity metrics to impress investors.

2. Growth can't be predicted yet 🔮

We saw above that founders shouldn't cave to external pressure when launching internationally. Instead, they should make sure it's the right time for them to invest in new markets. But how do you know the time is now?

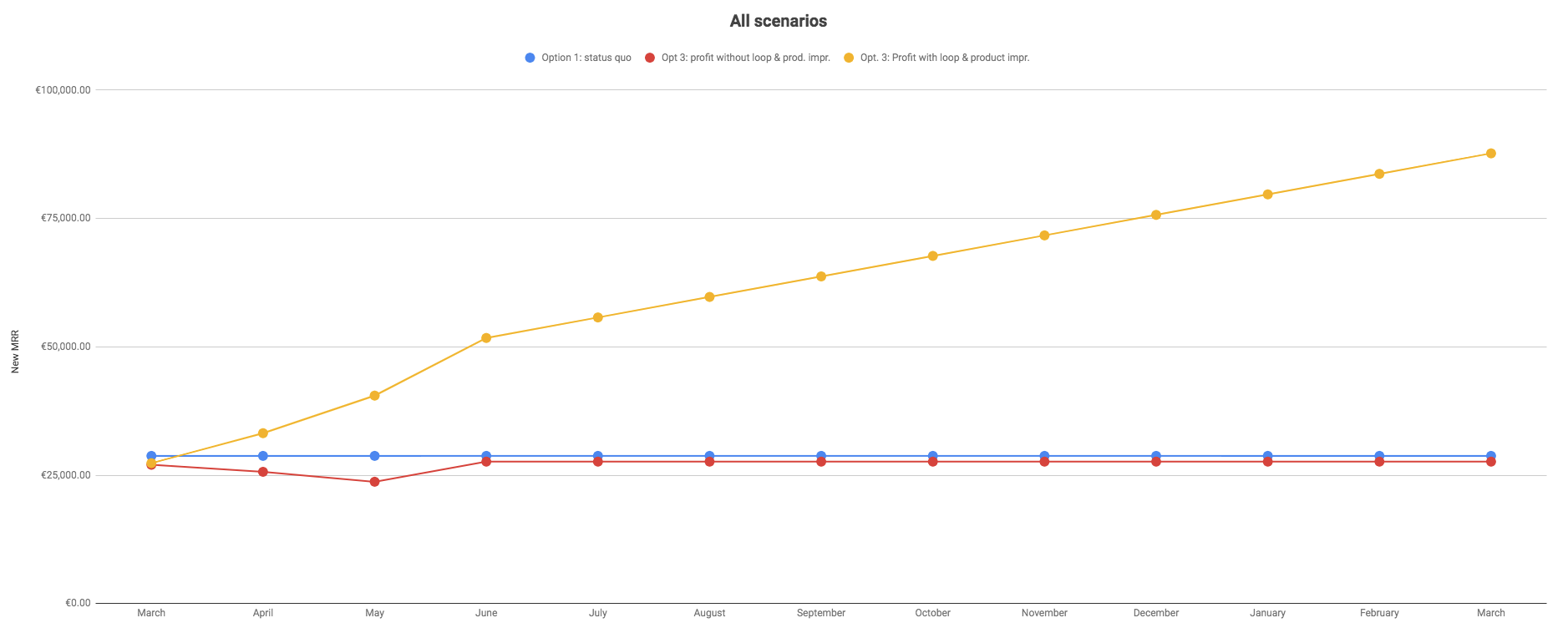

A key thing to look out for is how well you understand your growth. Do you already have product-market-fit and know what your organic MOM growth is? Do you understand what are the leaky parts of your funnel? Can you predict how much your revenue will grow in one quarter? If you spend € 10,000 on Google Search Ads, what is your predicted ROI? How much does your activation vary between inbound and outbound leads?

These are just some of the questions you should know the answer to, before adding gasoline to your fire. If you don't understand your product acquisition like the back of your hand, it's probably too soon. In the words of UK-based VC Scott Sage:

"I meet so many founders that feel the need to launch internationally even before being able to successfully forecast their bookings for the next two quarters in their home market. If your sales execution isn’t well understood yet, then it is definitely too early to consider serving customers in a new location."

This advice is not just valuable for scaling internationally. It's also relevant if you want to scale your growth in any way - by hiring marketers, sales representatives, country managers or account managers. When talking about scaling sales sustainability, this is what Karen Rhorer, former Sales Manager at Linkedin has to say:

"You need to understand the fundamentals before pouring gas on the fire because you want to make sure it’s going into a working engine, not onto a conflagration that will burn through your VC money."

Our advice to founders is always the same. Know your growth levers and product-market fit before expanding internationally. At Off The Record, we use frameworks to measure these two things:

- Growth levers: We build growth models to understand how a company's acquisition & funnel performs.

- Product-market fit: We use surveys and Superhuman's methodology to quantify PMF.

The first step for growth is often research and this case is no different.

3. Copy and paste tactics ✂️

Patrick Collision, Stripe CEO, once wrote: "At some point, there was a very noticeable change in how Stripe felt. It tipped from being this boulder we had to push to being a train car that in fact had its own momentum."

If you're making the choice of expanding internationally now, we will assume that you've had (relative) success in the Netherlands. Maybe you have organic growth or you're running ROI-positive performance marketing campaigns. Your company probably has its own momentum now.

However, you should be careful to not "copy and paste" tactics that are currently successful. Here's why: launching your brand in a new market is like launching a new brand in your home market.

What works for your acquisition now probably wouldn't have worked for your first 10 users. There are invisible levers that come from market penetration. Dutch website visitors are going to interact very differently with your brand:

- They probably recognise clients from your "customers" list. Maybe they're inspired by some of those companies or have worked with/for them.

- They could be already familiar with your brand and already know what you do, even if they've never used the product before.

- Perhaps they've seen your product "in the wild" before. They could know how it looks like in action.

- They could have a bigger connection with your brand than you know. Perhaps they've been to one of your events, are friends with one of your employees or have read about you in local press.

Your home market, at this stage, is likely performing very differently from new markets. When starting fresh, it's important to validate your product/service in the new market as if it's a brand new product.

Talk to local (potential) customers and build customer journeys/personas. You can't skip the legwork and blindly spurge on acquisition. That's not sustainable and you'll find out the hard way.

4. Founders away from the hustle 🏋️♀️

In our point above, we saw two factors that influence launching in international markets:

- Launching in a new market is like launching a new brand in your home market.

- What works for acquiring users now wouldn't have worked for your first 10 users.

Early stage startups' growth often comes from sheer brute force from the founders. Or, in the now-famous words of Paul Graham, by "doing things that don't scale". For your first international launch to be successful, that same hustle needs to put in by the founders.

Just finished our regular 50-person, 3-hour meeting covering Stripe customers’ asks and needs.

— Patrick Collison (@patrickc) March 27, 2019

Even when all teams are individually user-focused, there’s somehow no substitute for just getting everyone together and working backwards.

Personal connections and PR are often what kickstarts growth in local markets. Founders can help out by mimicking this network effect in a new market. These are some of the activities in a new market launch that founders should execute:

- Speaking in meetups and events.

- Reaching out and meeting other founders.

- Asking investors for intros to people well-connected in their new markets.

- Hosting private dinners.

- Sharing their "founder story" with local press.

There is no single way to grow, but a general consensus is that it's often difficult to get "those first users". By building a network in a new market, founders can help getting that initial traction going. And they're the best equipped to do this job.

5. Lack of local expertise 🏴

Every country has cultural differences, language barriers, different tones of voice and other unforeseen distinctions like legalization. No two neighbourhoods in Amsterdam, Utrecht or Rotterdam are identical, so you should never expect two international markets to behave the same.

If you don't have local boots on the ground, your international launch is deemed to fail. Often startups will try an "easy fix" to this problem: they hire a junior Country Manager. If this is your first new market launch or if you don't have a launch playbook yet, this is likely the wrong strategy. If you don't have the budgets for local expertise (agency/FTE's), you should really consider if you aren't too early about expansion at all.

We've covered how you should only be scaling your marketing/sales and hiring once you can predict your growth. If you're just starting out with international expansion, you cannot estimate how that will go (ROI-wise) and you should not be throwing bodies at the problem. And international expansion can be a big problem.

As we've seen, launching in a new market is similar to launching a new brand in your home market. It's challenging work that requires deep user understanding and often needs personal connections to kickstart growth. Would you give this big of a challenge to a junior hire?

At this stage, founders should be digging deep into understanding the new market's characteristics. The best way they can do that is by working alongside experienced, native professionals. As we saw above, founders should busy themselves with creating a network in the new market.

You could argue that there are some launch activities that are a lot of work and cannot (and probably should not) be executed by the founders, like organising a meetup. That's true. But instead of hiring a Country Manager to organise your first event abroad, try sponsoring an existing meetup or partnering with another startup. Experiment and be able to estimate results before scaling.

6. No product investment in l10n 🌎

We know there's no growth without product-market-fit. There's also no successful international launch without internationalization (i18n) and localization (l10n). In software engineering, localization means adapting a product into different languages and regional peculiarities of a certain market.

Here's how Georgina Rovirosa, Localization Manager at Kickstarter, describes:

"(...) localization encompasses taking a product and not just translating it, but also adapting it to a foreign language and for an international market. From an engineering or technical perspective, it could encompass anything. It might mean that as you’re building your product, you make sure that it supports things like [differing uses of] genders in languages."

A product could need to be adapted in order to be successful in an international market. Translation is an obvious need in some markets, but as Rovirosa says above, even that could come with technical changes. Your backend might require support for multiple genders for nouns, if you're translating from English to Latin languages, for example.

Apart from translation, here are some other market characteristics your product and engineering team should look into:

- Payment methods: What forms of payment and currencies do you need to support?

- SSO and incentivised social sharing: What social networks are used in this country? Is this a Whatsapp or an iMessage market? How prevalent is GSuite and Facebook?

- Device: Is this a mobile-first market? What OS will your new target audience use?

Sweden-based (population: 10 million) Spotify was, as of 2016, available in 50+ languages for their 40+ million subscribers worldwide. They've done a great job not just localising their product, but also maximing the global potential of their universal features.

Their running playlists are a great example. They utilize the users' running rhythm to build them a custom playlist based on their tastes. Gustav Söderström, Spotify’s Chief Product Officer" said himself: "(Running is) a major activity in each country.” By analysing existing running playlists around the world, they built a feature for the global market. I recently finished the book about Spotify, written on 70 sources around the company and Daniel Ek, I can highly recommend if you want untold stories, the good, the bad and the ugly.

7. Cities over countries 🎯

One of the problems we see - and this one is often influenced by investor pressure - is that some startups want to conquer an entire country at once. When, instead, they should focus on the more effective approach of winning over a certain city or area first. Don't go for the United Kingdom before trying to acquire East London.

Acting local has three big advantages:

- The smaller the size of your target market, the smaller will be the differences between your target customers. Starting with a geographical niche makes the localization of your product easier.

- The similarity of your target audience also makes it easier for you to track and measure the campaigns (offline and online) you run. As we've seen, you cannot scale before understanding your growth.

- The more niche your target audience is, the more personal network nodes will be connecting them together. That should increase referral rates, which are very important for getting those tricky first customers.

Go niche or go home.

For deciding which markets to prioritise, it's important to consider factors such as local competition, market size and timezones. London-based VC Balderton has a nice guide on how to prioritise which markets to expand to.

Conclusion

In this article, we covered the main struggles Dutch companies face when expanding internationally. We've seen that: 1) International expansion shouldn't be seen as a way to get vanity metrics up. 2) You should do your research to know if your growth is equipped for new markets. 3) Once you've decided it's time to expand abroad, it's important to start targeted with founder buy-in, local support and engineering investment.

At Off The Record, we help to build viable business together with founders and corporate innovators. We're a Techcrunch-recommended growth bureau that has helped Dutch startups scale globally.

Please subscribe to stay up to date with all our content.