How Corporate Innovation Can Be A Perfect Love Story

A story to understand fallacies during the quest for new corporate business models and how to overcome them, based on helping a dozen of corporates and built upon thoughts of thinkers far greater than myself.

Most large corporations operate for already decennia in specific markets for distinct audiences and have deep pockets to reel in top talent. A position where most startups clearly don’t find themselves in.

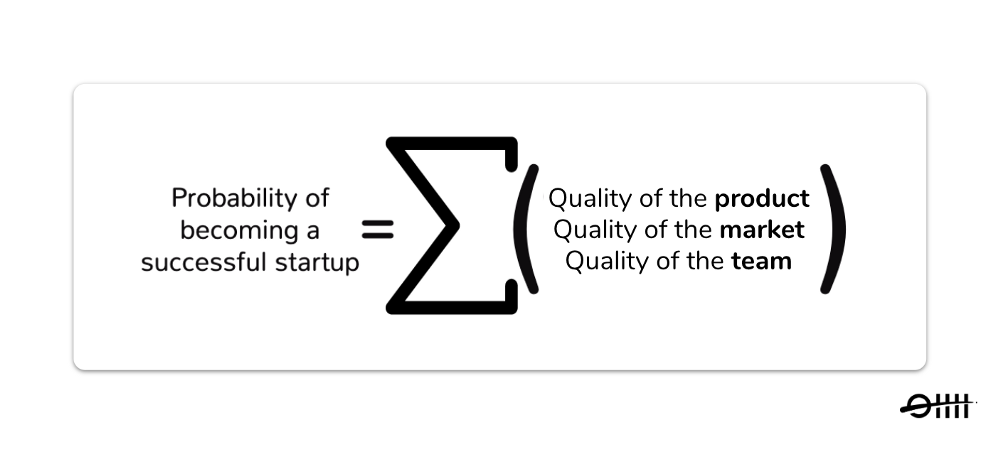

Regardless of the setting through which innovative juices flow, the probability of success foremost depends on the sum of how well your Product, Market, and Team is. According to this equation new viable business models and corporates should be the perfect love story, right? Unfortunately, it’s not. At first glance starting a new venture in a corporate environment seems easier, but it’s probably tougher to succeed than outside of it.

The crux here is legacy.

Legacy can be seen as a situation that has developed as a result of past actions and decisions. Corporate organizations throughout the years optimized for gross margins, profit maximization and scale which has a strong reflection on the situation that a Team endures when operating at corporates. It partly defines how individuals work and are ought to work due to incumbent processes. Let’s call this the Corporate Environment — something that can be quite tedious for an innovation team, to say the least.

In this essay, I identify four factors within the corporate environment that in many occasions slow down successful innovation and handout some advise from the trenches on how to overcome these issues.

- 💰 Available Capital

- 📊 KPI-driven

- 👨🏼💼 Leadership Team

- 🌟 Culture & Motivation

1. 💰 Available Capital

Yes, I hear you thinking. “How can an abundance of capital be a factor that can significantly hamper successful innovation?” And you’re right. Partly.

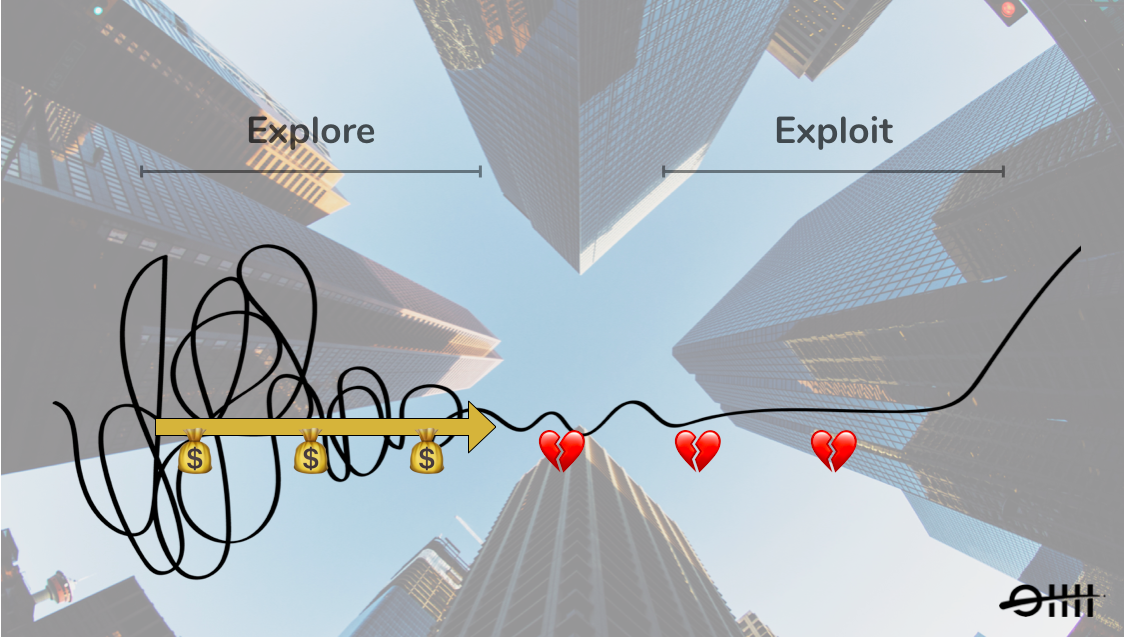

A new business, or any project for that matter, is nothing more than an accumulation of risk. Nothing is for certain. Everything is an assumption at t=0. It’s up to the founding Team to de-risk these Market and Product assumptions and iterate or pivot towards Product-Market fit in the process. Also described as a phase of Exploration by Alex Osterwalder.

A new business is, at t=0, nothing more than an accumulation of risk with a potential future pay-out based on Market share

However, most of the times new business ideas sparked through a creative idea by the board, a hackathon or — the riskiest one in this category — an on-paper and in theory profitable business case. These ideas may seem like a lucrative opportunity in the eyes of stakeholders who in return will pursue this relentlessly by putting money into the project to seize and grow this business opportunity.

The abundant funds available at big corporations enable stakeholders to go full throttle, and probably hire a big-ass Team. All too often, this results in a full-fledged team with deeply skilled individuals in a business that still is uncertain whether it delivers true customer value to a worthwhile Market — a full-fledged Team before Product-Market fit.

Because of the invested capital and corresponding team, the venture is expected to full-on Exploit this new business model. This tendency makes it highly unlikely for innovation teams within multinational moguls to get the chance to Explore their way to viable business models. However, to learn about your Market and Product in the Explore phase is crucial to future success since I have yet to encounter a founding Team that had all of their initial assumptions spot on. And this is the exact moment where loads of capital paralyzes corporate innovation.

This business then is equipped to grow while it still faces the risk of having the wrong Product for the wrong Market. Sure, a shit ton of money helps you to run tests, iterate the product and gives you a runway to de-risk your business. However, it’s never a direct trade-off for the time necessary to explore, learn and de-risk.

❤️ Some corporate love advice:

- Keep the founding Team as small as possible (max. 4/5), until it’s ready to exploit their business

- Keep investment for the new corporate venture to a minimum necessary to explore and validate Product and Market assumptions, so it won’t feel internal pressure to show revenue results quickly

in general, hiring before you get product/market fit slows you down, and hiring after you get product market fit speeds you up.

— Sam Altman (@sama) June 16, 2015

2. 📊 KPI-driven

Let’s assume a hypothetical corporate venture indeed has one of their crucial assumptions wrong; let’s say the ones concerning their Product. Given their funds — hence runway — it still wouldn’t wipe out their chances of survival if the Team would still iterate their way to an acceptable state of PM-fit. But the moment C-level opened the money floodgates real good, they let the genie out of the bottle. From that moment forward they want to see charts with graphs hockey-sticking to the upper right because it’s their asses on the line and because they truly believe that now is the time to shine for the new-sprung business.

The Team will be pushed to increase their business metrics and the pre-maturely hired and deeply skilled team members will fiercely execute on that demand. They will craft nifty marketing campaigns for acquisition and email sequences to push engagement and retention, while the Team should actually be learning on how they could improve the Product and/or refine the Market — called iteration.

The number one predictor of success for a very young startup: rate of iteration.

— Sam Altman (@sama) October 2, 2018

The course that this new venture is following is very risky and if the high-over strategy doesn’t change, it’s very likely that eventually the project will be killed since it can’t deliver on the targets and KPIs that management required to see.

❤️ Some corporate love advice:

- Have generalist team members in the founding Team which have a natural tendency to not solely focus on execution and exploiting, and let them have a focus on Customer Development

- Look for individuals who have experienced operating in a like-wise situation—employees that priorly worked at start- or scaleups and/or former entrepreneurs as unit lead. They can gently push stakeholders better to make the right decisions

- Steer on metrics that showcase traction and market adoption instead of for instance revenue—e.g. have the team acting on their North Star Metric and/or metrics suited for the business model and stage, and look for core value that is delivered to the right audience

3. 👨🏼💼 Leadership Team

The ones that are mostly responsible for the aforementioned flawed goal-setting is management. The Leadership Team of big corporates consists of seasoned C-level managers with serious years of experience under their belt in their operating space. This makes them excellent in overseeing execution and leading teams in proven business models. But they are not necessarily experts in innovation.

Because they’ve become successful in doing things the way they do, they will continue to do things the way they always did. But innovation per definition sets itself apart from the status quo, therefore requires a different approach.

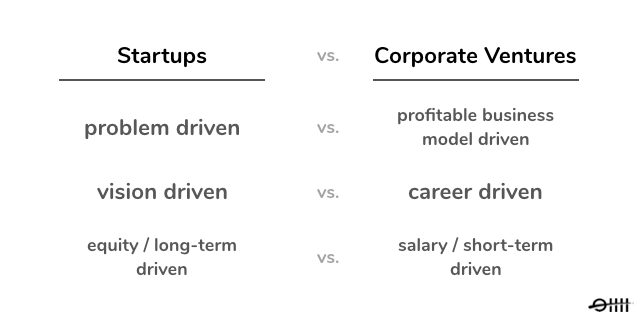

They’ve built businesses that please shareholders, and that reflects on their decision-making process. Where most successful startup founders are driven to solve a problem for which they built a solution, the Leadership Team within corporates is frequently business model driven — they see an opportunity to seize instead of a need to fulfill. This is a direct cause of their imposed KPI-driven strategy.

Another challenge within their general decision-making is the tendency to hire employees with profound experience in the current vertical but not with the new type of business model. Seldomly I find tech unicorn heavyweights in C-level functions or in founding corporate teams while it might be better to hire people fit to the stage and dynamics of a new business (exploration and high-growth) than the vertical in which that new business operates (FMCG, media, etc). And these decisions weigh heavy on the already sturdy culture at work in corporate environments.

❤️ Some corporate love advice:

- Make sure there is enough organizational distance between the corporate venture and the rest of the organization, so the newborn has the space to roam freely and be truly self-steering to Explore it’s Market and Product and is not burdened by institutional legacy

- Enable that Innovation reporting is done to a separate part or layer of the board. One that has profound knowledge of Innovation Accounting and can act as an internal VC—ideally a Chief Innovation Officer

4. 🌟Culture & Motivation

But to only blame the Leadership Team for flawed decision-making and Innovation Theatre would be a shortcoming to reality. The Team of the corporate venture itself most of the time works out of unaligned motivations.

For many, it’s the next step in their corporate career and at large businesses creating something shiny and bright always results in eyeballs. But don’t think for a minute that startup founders make their move into entrepreneurship because of a bigger career path. It’s because of their passion or vision on a specific vertical, target audience or problem that need solving. So corporates endure individuals who are career & salary driven, whereas startup Teams are driven by passion, vision, and equity. And unfortunately, the former doesn’t align well with what is good for the long-term perspective of new businesses.

❤️ Some corporate love advice:

- Ideally, hire 1/2 heavyweights from tech startups which have seen a new business emerge from nothing but assumptions until $50mio> revenue or successful IPO and give them the freedom to spark the right culture and mindset

- Hire for vision and passion to mimic startup team dynamics and culture all the while reaping the benefits of operating in a financially strong environment.

Off course the mentioned situations above are an oversimplified and amplified illustration of reality. So if corporates are aware of the potential negative vectors while they hustle on new business models, they might fall head over heels in love with innovation and the two will live profitably and successful ever after.